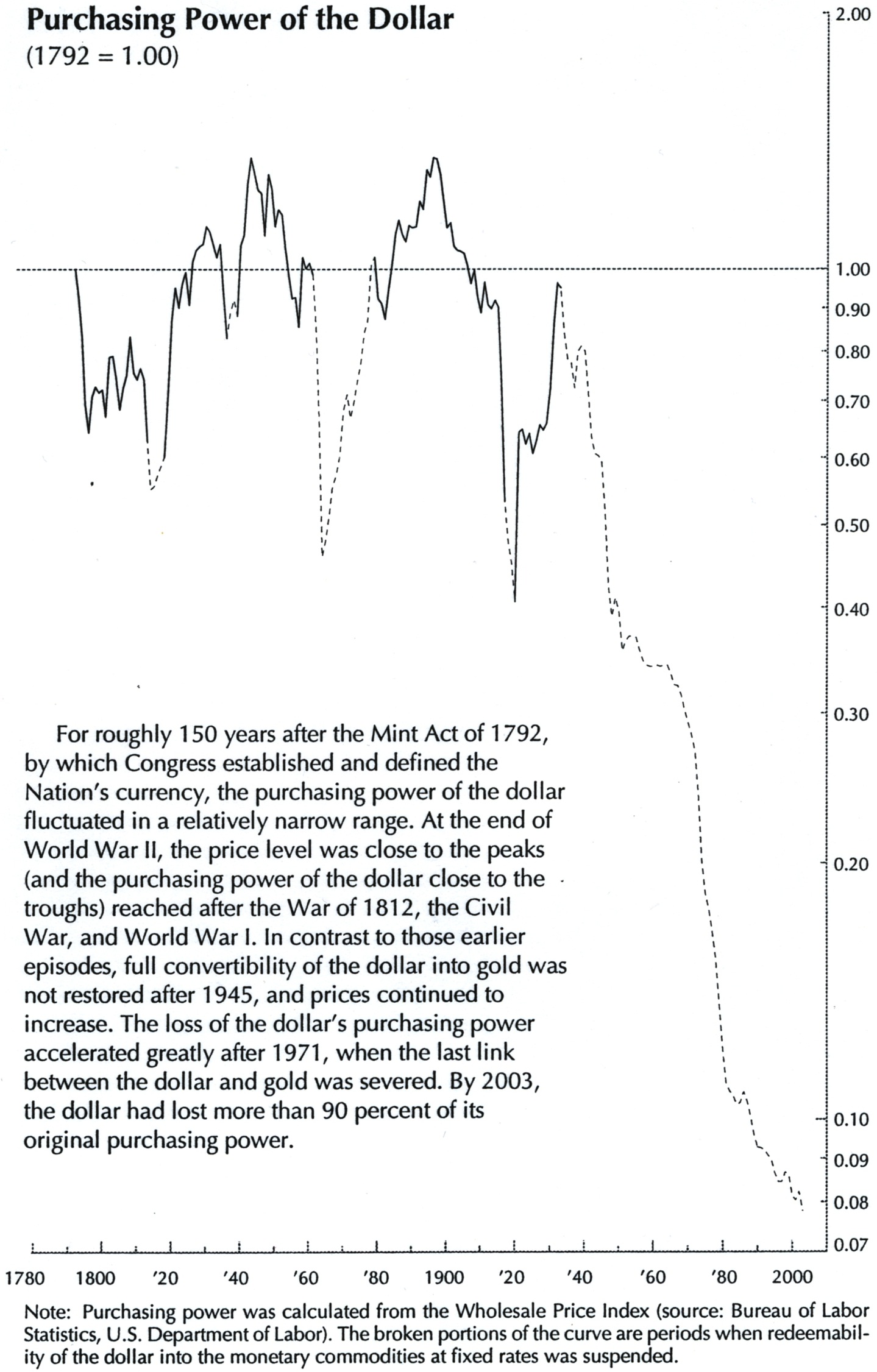

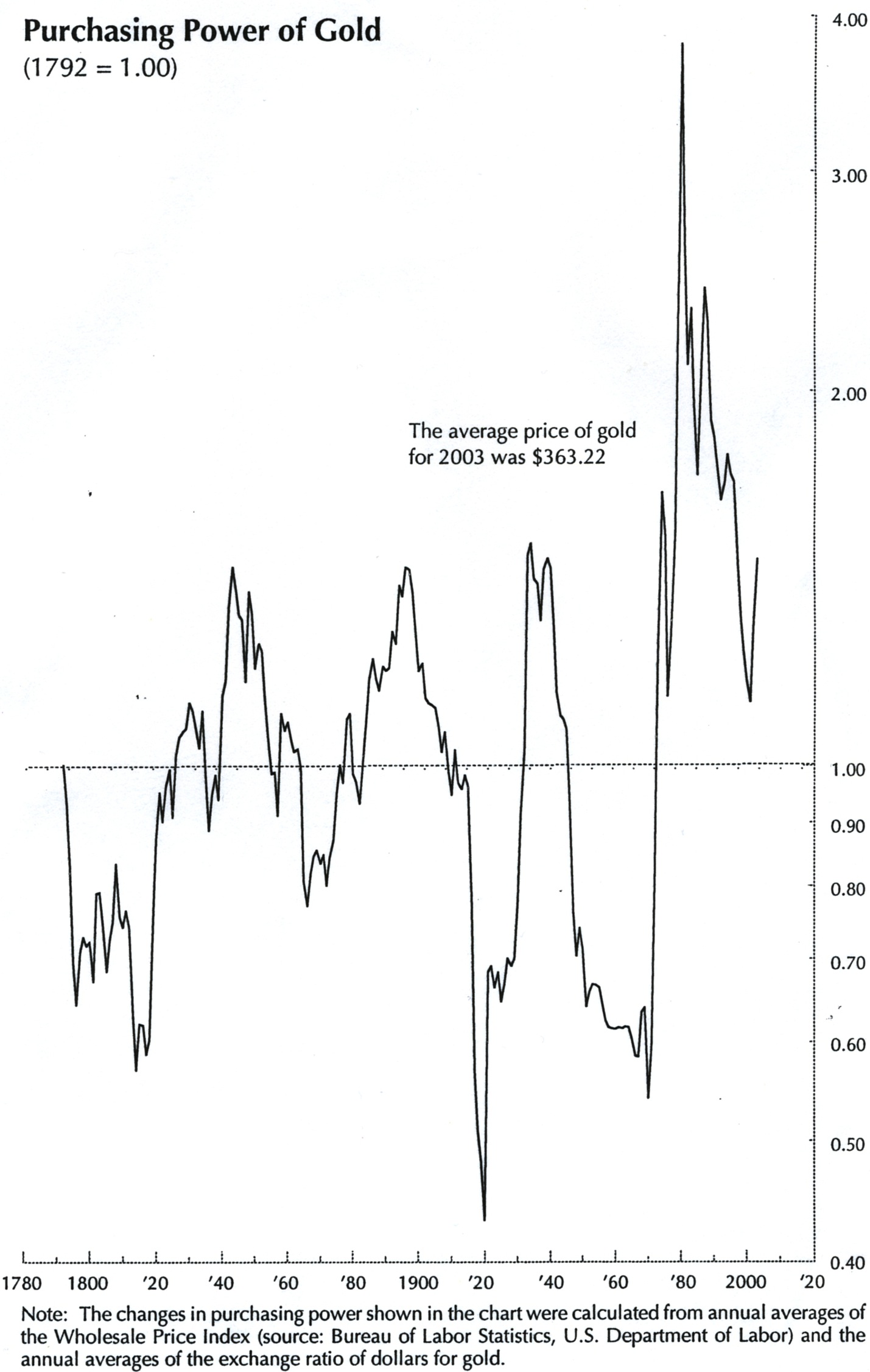

Purchasing Power of the Dollar vs Gold

ST. LOUIS (MineFund.com) — History speaks rather clearly about certain things, and purchasing power is one of them…

Other charts you may find useful: Precious Metals Prices Adjusted for Inflation | Gold Ratios | Silver Ratios | Gold Equities | Exchange Traded Gold or use the commodity dashboard to navigate all our resources.

Source: AIER - American Institute for Economic Research.

[...] Read full article (with charts)… [...]

Prices are only just beginning to rise. No dealer wants to price his goods above the competition, but with basic materials rising, he has to follow suit. Once the price rises get started, they will accelerate. Buy any appliances, cars, clothing, etc., now, that you think will be needed in the next few years, or they will become unaffordable for even the wealthy. Stock up.

I agree Chuck:

And, not only are prices rising, packages are 25% smaller on average, which immediately translates to 25% inflation, on top of the price increase which is hovering at about 18%…43% inflation? And the media is reporting a CPI increase of 3.9%. Disgraceful!

Who cares about destruction of the unit, if you keep on making more and more to cope with the change in value. Your fascination is historic and irrelevant. People worked for a dollar a day in 1840!!!

Only less than 2% of the US populations makes “more and more” (not too scientific there pal), and the other 98% makes less, in dollar terms, let alone real currency. You go with your plan. Good luck. The world needs people to continue to believe as you do.

“Who cares about the destruction of the unit [US Dollar]…”? How about people who worked hard their whole life, have money in the bank & those now on a fixed income!? Devaluation of the US Dollar winds up, in effect, a hidden tax! It’s taxation without representation as the Fed (unelected people) can do whatever they want (without fear of audit or consequences) & destroy the value of the US Dollar. As a nations monetary system goes, so goes the nation. The USA is heading down the drain fast.

Absolutely,

Worse, when hyperinflation hits people on fixed incomes, and the pensions are drained, we are going to see massive foreclosures, loss of property, maybe even suicides and murders. The “working class” has been so exploited by the wealthy and our corrupt government that they will, yet again, bear the brunt of hyperinflation and economic collapse. This time, however, even the super rich may discover that their money is worthless.

Joe, I’ve deleted your anti-semitic comment. What on earth would drive you to say something like that?

Michael, Yes people make more money, but the money they make is worth less and most people do not see an increase in pay to make up for the difference.

In 1959, I got my first allowance and Twinkee twin-pack cost 10 cents. When it went up to 12 cents, I did not get a raise. I saw a Twinkee twin-pack in a store recently for $1.35 and the Twinkees were smaller.

In 1969, when I got my drivers’ license both a gallon of gas and a gallon of milk were 25 cents. Now, they are both about $3.50.

Ten years ago gas was about $1.319 and gallon and not it is about $3.519. How many people do you know that are making 2.67 times as much as they did 10 years ago? Inflation is a losing proposition for most people.

Dude what Planet are you on?

The fact of we make more so ultimately we can spend more has got to be the most financially msnbc thing I have ever read or heard. Gold and silver have a 5000 year history. Dollar has 235 year history and very unstable last 40 years. I feel very bad for you due to your perception on the fiat currency system.

I am actually stunned at this comment of “who cares about destruction of the unit?” Does Gemany in the 1930′s not mean anything to us? History always repeats itself. I honestly do not know how to comment on this except for to I am speechless to this view the represents I dare say the view of many uneducated Americans. Then again it will be the uneducated that will lose everything through the QE.

Coltan, I share your sad amazement over that previous comment made above. I also think that the worthless currency in the Weimar Republic in Germany can happen again. Why? Now let me add one clarifying point. History does not repeat itself, people do. Or, if history always repeats itself, it’s because people inevitably fall again and again into the same illusions about how to live, and make a living, for themselves and others. That keeps the focus of responsibility where it belongs and from becoming so abstract we fail to see how anyone can correct it. Add to this the “normalcy bias” of a society to avoid change when needed, and it will be sure to happen eventually…unless a new wisdom takes hold and leaders step forward to show the way.

Socialist dupe, what you refuse to see is that the job suppliers do not “trickle down” the costs that they

sustain doing business. The workers in the trenches eat the inflation and the elites redistribute the wealth.

Hmm, sounds like this admin. doesn’t it.

Calculating the purchasing power of gold by a very crude extrapolation to the current price of around $1420 vs. 363.22 in 2003, while not factoring in the inflation between then and now (please do if you have the numbers!), gold would be at 3.9 on the scale, which would be near the peak shown in the early 1980s on your second graph.

Unless you come back and tell me that inflation puts us well below the prior high so we could spike to there, fine - then gold has more room on the chart to the upside. But if not, gold is relatively overvalued now NOT vs the dollar but relative to other “stuff,” which is what the wholesale price index references. That would indicate that in terms of real purchasing power of gold (not as protection against the dollar going down even more), it may be time to be buying companies that are profitable rather than buying gold. It may be time for a hedge against the dollar and a hedge against gold price inflation, which is why Warren Buffett keeps buying companies that will earn more if there is inflation (in the end anyway - even if stock markets initially drop during an inflationary period). Company earnings always are recalibrated in dollar terms regardless of what the government does with the dollar.

I keep a core position, but my trading GLD position is now zero. Gold has formed a big top and is still in correction until proven otherwise in my opinion- and I’m always willing to be proven otherwise. I just need the proof. Thanks for the informative charts. They show how gold needs to be valued against more than just the dollar to be sure it’s a good buy vs. other options. Best regards, Dave

P.S. Please feel free to check out my blog as well at the link noted. I have been discussing the relationship of stocks, gold, and the US dollar for many months.

Thanks for the comments, David, very helpful. I’m working up the later figures. One thing to bear in mind is that CPI is no longer calculated the same way it was. Using Shadow Stats data indicates that gold remains relatively under-priced.

The other issue to bear in mind is that gold’s relative decline against the USD in the 1980s was driven by a strong dollar policy. I do not see any political leadership willing to replicate those policies. On top of that we have the welfare state crises now accelerating to a crash within the near future (15 years?). Those threats were still a long way off.

Also, there was nothing to compete with the US at that point except Japan. Now the G20 nations are a force that must be counted because of their low debt loads, young populations, and growth oriented economies (low / flat taxes; tolerable regulation; deregulation; liberalization etc). The US can no longer compete based on its legacy - it has to return to competing with what originally made it great.

Rgs

Tim

I think anyone trading gold or silver to get rich sort of speak is doing it completely wrong. This is an opportunity to truly hedge yourself. To protect yourself from losing everything. This economy is 180 degrees opposite of the great depression. After the market crash of 1929 it was a depression of deflation. This is a depression of inflation. And the worst hasn’t even begun…

Answer me this… The Federal Reserve that controls the US Dollar is lending to the US Treasury and Gaddaffi banks? And giving Gaddaffi banks lower rates? How does that work? It is as if both sides are being played.

It is simple supply of law and demand. There is an endless supply of US Dollar pumping into the system and most every country out there is running from it. So the United States is getting stuck with the bill as Bernanke assures us nothing bad is going on… in the market is improving!! What!? Really!?

Gold and Silver are there to simply preserve what you have… and probably have a huge increase as a bonus when the US Dollar is killed as we know it.

And please if there is a plausible way to save the US Dollar, please… please anyone please explain to me how!!

Colton

The only way to save the dollar is for the Federal Gov’t to run a Budget Surplus from now until the Sun burns out. That would immediately stop the Federal Reserve from having to monetize the debt. That’s in theory how you do it. Does anybody think the Federal Government can do that? If so stay strong with what you have. If not, I’ll see you at the Gold and Silver Markets. Hopefully I will be there in front so I get a lower price!

Point proven! Haha Thanks. Wanna see something way interesting check out these charts I was looking at this morning comparing the US Dollars in circulation VS Silver Prices. I posted them on my site at http://www.thebsidetothetruth.com/?p=527. Super interesting as the huges spikes in silver are right after huges increase in circulation ever!

[...] This chart at Minefund.com reveals the time of the “invention of fiscal lying”: Purchasing Power of Gold and the US dollar since 1792 [...]

Tim,

I referenced this page on my website. And I answered your comment there and you can reference the link that follows if you like. I’m sure my readers will enjoy your graphs and your readers will likely find my discussions of the relationship between stocks, the US dollar, and gold to be of interest. I look forward to seeing your updated numbers when you can get to it.

http://wp.me/p14gPd-cY

The gist of it is that the 1980′s strong dollar policy was Fed driven. In my post, I point out the irony of Bill Clinton, the only President to even come close to telling the truth fiscally despite his moral compass at home being lost at sea!

best regards,

Dave

I’ve enjoyed looking over these charts - thanks for assembling the information in a neat visual form.

Why was the purchasing power of gold so low in 1920? I know there was a US recession/depression

The Depression started when the government panicked in response to the market crash of 1929, and instituted a series of policies that locked up the credit markets and made conditions worse. Hoover, and then Roosevelt, compounded these errors for a decade until the US went to War. The dollar was strong in the 1920s because of the amount of gold being exchanged for dollars that were being invested in speculative and conventional securities.

There’s a similar graph here:

http://www.aier.org/research/briefs/1826-the-long-goodbye-the-declining-purchasing-power-of-the-dollar

If the the dollar was $1.00 in 1913 when the Fed started, it was down to 4.6 cents in June ’09. Of course, it’s worth even less now.

Tim,

The other point is to factor in the standard of living increase drive by income increases since 1792. We are a bit better off than then! So we need an income adjustment to all this data to compare apples to apples. You can say that if you held a dollar from 1792 that it would be worth X in purchasing power today and if you held gold for that long as well, it would be worth far more in purchasing power, but you have not adjusted for the increase in that buyer’s income, correct? So if you adjust for income, where does that “adjusted” dollar land on the chart if you adjust for 1792 income vs. 2011 income for example? Where is Ben Franklin when you need him! I’m sure he’d have those numbers. ; )

best regards,

Dave

The charts are both from the AIER American Institute for Economic Research. I have them both in a 24″ X 18″ format on glossy poster board.

The AIER was formed in the Depression by a man named E.C. Harwood. It is apolitical and nonprofit. I consider it to be a “Consumers Reports” for personal finance and have been a member since 1980.

They put out an “Economic Bulletin” monthly and regularly show Business-Cycle Conditions;

leading, coincident and lagging economic indicators.

Interestingly, the March Business-Cycle Conditions issue is titled “Not Your Textbook Recovery” “Persistent problems remain as lagging indicators weaken”.

I often recommend them to friends who want to learn more about economics without reading 400-page books. (Is it just me or do all economists have trouble getting to the point when they are writing?)

Thanks very much for identifying the source.

Interesting article. I wonder is there any commodity (including gold) that can’t be overpriced? What would our economy look like without paper money or too much of it. I doubt gold would play an important part in it because a relative few would have it. Paper money has come and gone before and if you really want to know what will likely happen you can study europe during WWII and any other country that imploded.

I believe you might be better off if you hoard soap and toilet paper.

@Jeff, I was asking the same question the other day. I work in business and was thinking on how if the paper dollar is decreasing in value who’s to say the same wont happen with gold eventually? Also, I see your point about the economy. Our economy would look a little odd without paper money but I found a website you might want to look at called the Gold Standard. They really nail gold on the head. It explains alot how gold is the better choice and I for one have to agree after reading this: http://www.thegoldstandardnow.org/history/why-the-gold-standard

Read it and let me know if it changes your stance.

Harold

The Anglo financial power elite will see to it that the dollar is stronger. Most likely the majority of their

assets are in America. Same thing happened in the 1930′s depression. Lenders hunkered down and stopped lending. Then the economy really contracts. We are getting a Kondratiev long wave repeat.

It’s deja’ vu all over again.

Gold buys about the same now as it did one hundred years ago. Gold and silver follow inflation and in the case of the dollar it has a fertile field to work in. I sold a gold mine last summer for $10,000, I had a choice between cash or silver, I chose silver. I so far have more than doubled my selling price if I sold my silver today….. You don’t really make money with precious metals, you just keep up with inflation…

So what you are saying is that we had 100% inflation over a 1 year period? I don’t think so! I would say that we have had 9-12% inflation. The rest is appreciation for a stable currency in silver, rather than a unstable currency in the Dollar.

If the people don’t pay taxes to cover government spending, the Federal Reserve “prints” or creates money to cover the debt. Our politicians don’t like to increase taxes; they won’t be re-elected. They rely on the Federal Reserve to pick up the tab; thus, the poor and the middle class pay an INFLATION TAX. The wealthy are protected because they own assets which increase in value. The INFLATION TAX is evil; it destroys the progressivity of our system of taxation. It destroys savings.

Between 1881 and 1912 the purchasing power of the dollar remained the same. However, after the establishment of the Fed in 1913, due to quantitative easing the purchasing power of a dollar in 1913 declined to less than $.04 in 2009. What more evidence do we need. The government must quit playing games and put an end to the creation of monopoly money. They must abolish the Federal Reserve; then they will have no choice but to live within its’ means.

Forgive me for being cynical, but the FED being a private bank, it’s own shareholders to answer to, really ins’t necessarly on our side, is it? Their in business to make money, and if they make higher profits if interest rates are high then it behooves them to inflate the dollar to get that rate. Infation steals the purchasing value out of the dollar, I’m sure that the FED has figured a way to arbatrage that aspect for their own gain, after all, they’re running the worlds central bank, they’re not stupid, they’re gaining the value that we’re losing.

Since the Federal Reserve was established in 1913, the chairmen of the Fed and the twelve commissioners have been responsible for decline in the purchasing power of the dollar. Witness, the purchasing power of the dollar from 1913 to 2009. The purchasing power of the dollar has been diminished by 97%. It is currently worth approximately $.04 compared to the dollar in 1913.

It is the manipulations of the Federal Reserve in the creation of dollars that has resulted in a inflation tax which is paid by current and future generations. When the tax payer does not pay sufficient taxes to off set Congressional spending, the remaining deficit is paid by the Federal Reserve, thus resulting in a form of taxation referred to as the inflation tax. It is an unfair tax. For one, it defeats the progressivity of the tax system. The savings of the middle class does not keep up with the inflation tax. Those tax payers who own the right mix of assets, the wealthy, are able to keep even with the inflation tax. The poor and the uneducated fall behind.

As long as Congress has the Federal Reserve, what incentivizes Congress to increase taxes to pay for the deficits? To increase taxes would be highly unpopular and they would not be re-elected. Congress is aware the Federal Reserve is the payor of last resort. It’s the so called default position. The Federal Reserve is conveniently available to initiate the inflation tax. It’s what they know best and they see it as their job. It ‘s essentially a “Monopoly Game”. Add more money to the game and they can continue to keep it in play, for a long time.

President Reagan had a theory called “Starve the Beast”. To rein in the spending of congress, Reagan’s idea was not to give Congress all the money it demanded. The taxation of the electorate was too low in that it did not meet the spending needs of Congress. Unfortunately it resulted in large deficits during President Reagan’s term in office.

“Starve the Beast” was not a valid theory. It had a major flaw. The President overlooked the power of the Fed. The Federal Reserve, the default position, was ready and willing to be the payor of last resort. And, thus the taxpayer continued to the pay the bills via the inflation tax.

The Federal Reserve did not exist during the first one hundred plus years of our country. And, over a long period of time the purchasing power of the dollar was retained. In the next fifty years, today’s dollar may only be worth $.02, unless Congress puts an end the Federal Reserve. To end the INFLATION TAX Congress must put an END TO THE FEDERAL RESERVE.

What is truly scary to me and what so many others arent talking about or considering is that the US has the most powerfull military ever conceived. If the US economy does actually fall our country will get desperate……. desperate countries especially onces with a military this powerfull may be forced or think they are forced to do the unthinkable.

I am a peaceful and reasonable guy. I am holding cash and CD’s only.

I know of very many well armed and less reasonable guys and gals (rednecks) in this area.

They have invested in gold and ammo for their many weapons.

You do the math…

The army is not allowed to wage war on the citizens, but the citizens can attack the government as is becoming evident in many countries on the other side of the pond.

Is it going to become wise for me to move to one of the growth economies like Brazil just to survive this monumental government monetary screw-up?

[...] http://minefund.com/wordpress/2011/0…ollar-vs-gold/ Quote: [...]

I’m writing this on July 23/2011. A fair analysis would conclude that the EU is bankrupt, the US has 2 weeks to come up with a workable plan to avoid defaulting. Virtually all Western currencies are now backed by debt only. The big banks are buying up precious metals…G*d only knows what they’re paying for it with; and there’s a huge shortage of refined physical Silver to complete existing Futures contracts. All in all not a good time to be holding paper of any kind.

[...] has a history of detaining people and holding them incommunicado. (Read: Yes, your currency will be made worthless. Your retirement fund will be plundered. Food will become scarce. The internet will go down. Many [...]

I looked at the first diagram and kept scrolling lower, lower and lower…Are we the only ones who see that…

mmmmm????….federal reserve notes or gold and silver coins..which would you like to put in your grandchildren’s stockings this Christmas??? or better yet which would you like to have in your own stockings???